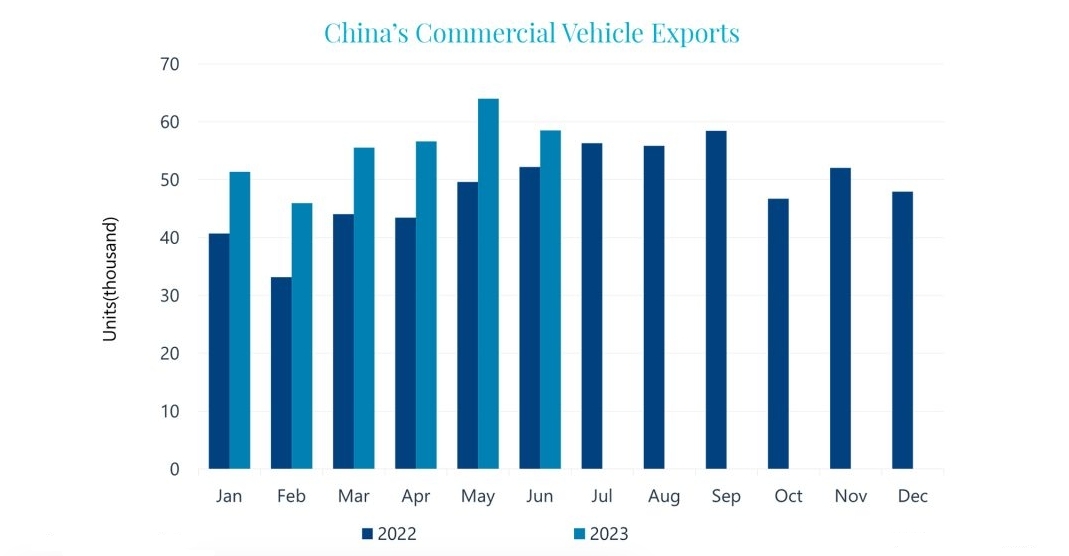

The export market for commercial vehicles in China remained robust in the first half of 2023. Export volume and value of commercial vehicles increased by 26% and 83% year-on-year respectively, reaching 332,000 units and CNY 63 billion. As a result, exports play an increasingly important role in China’s commercial vehicle market, with its share rising by 1.4 percentage points from the same period of last year to 16.8% of China’s total commercial vehicle sales in H1 2023. Furthermore, exports accounted for 17.4% of total truck sales in China, higher than that of buses (12.1%). Based on statistics from the China Association of Automobile Manufacturers, total sales of commercial vehicles in the first half of 2023 reached almost two million units (1.971m), including 1.748m trucks and 223,000 buses.

Trucks accounted for over 90% of total exports

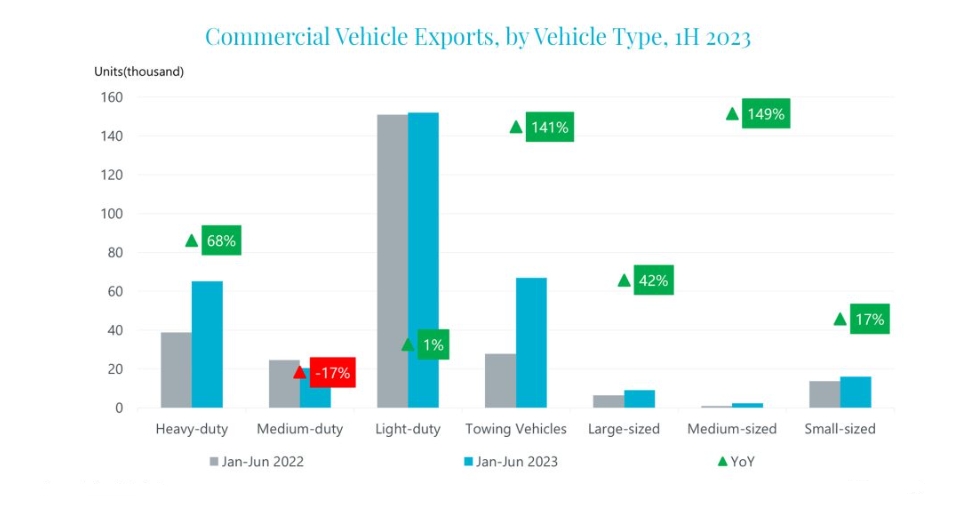

Truck exports showed strong performance: From January to June 2023, China’s truck exports stood at 305,000 units, up by 26% year-on-year, and valued at CNY 544 billion, with a year-on-year increase of 85%. Light-duty trucks were the main type of trucks exported, while heavy-duty trucks and towing vehicles experienced the fastest rates of growth. In the first half of the year, China’s exports of light-duty trucks reached 152,000 units, or 50% of all truck exports, with a slight 1% year-on-year increase. Towing vehicle exports experienced the highest growth rate, more than 1.4 times year-on-year, responsible for 22% of total truck exports, and heavy-duty truck exports increased by 68% year-on-year, accounting for 21% of all truck exports. On the other hand, medium-duty trucks were the only vehicle type that experienced a decline in exports, down by 17% year-on-year.

All three bus types increased year-on-year: In the first half of this year, China’s cumulative exports of buses exceeded 27,000 units, up by 31% year-on-year, and total export value reached CNY 8 billion, an increase of 74% year-on-year. Among them, medium-sized buses had the highest growth rate, with a smaller export base, reaching 149% annual growth. The proportion of total bus exports made up of medium-sized buses increased by four percentage points to 9%. Small-sized buses accounted for 58% of total exports, down by seven percentage points from last year, but still maintaining a dominant position in bus exports with a cumulative export volume of 16,000 units in the first half of the year, up by 17% year-on-year. Export volume of large-sized buses increased by 42% year-on-year, with its share up by 3 percentage points to 33%.

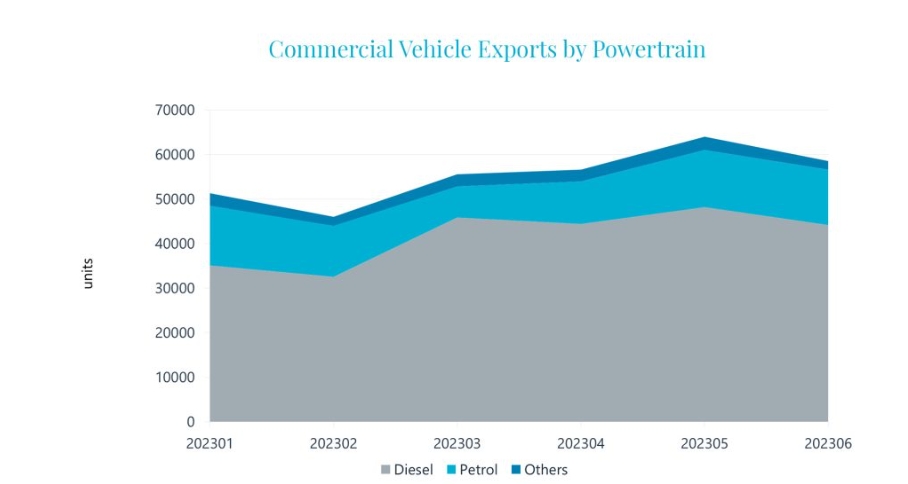

While diesel commercial vehicles were the main driver, new energy vehicle exports grew fast

From January to June, exports of diesel commercial vehicles showed strong growth, increasing by 37% year-on-year to more than 250,000 units, or 75% of total exports. Of these, heavy-duty trucks and towing vehicles accounted for half of China’s exports of diesel commercial vehicles. Exports of petrol commercial vehicles exceeded 67,000 units, a slight 2% decrease compared with the same period last year, accounting for 20% of total commercial vehicle exports. New energy vehicles had cumulative exports of over 600 units, with a remarkable 13-fold year-on-year increase.

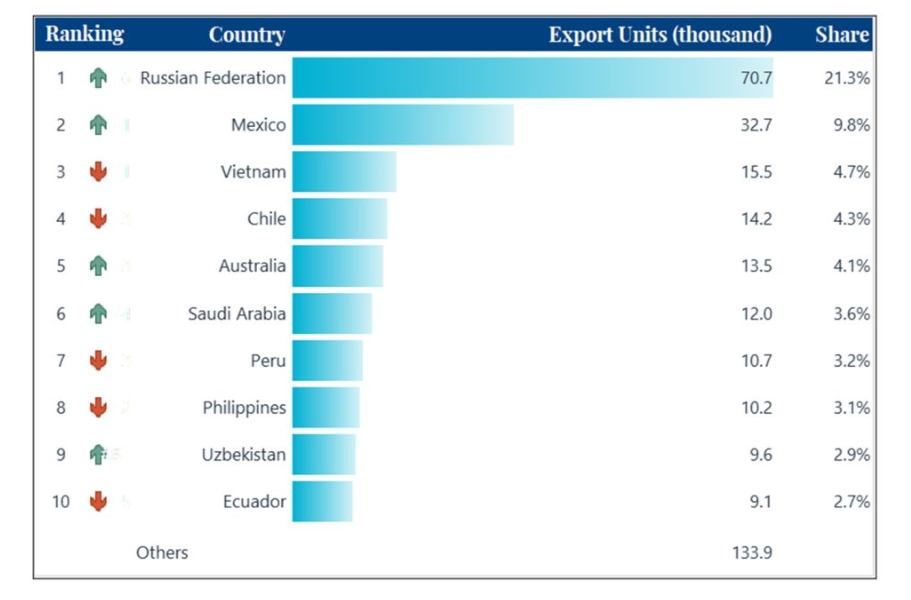

Market landscape: Russia became the largest destination for China’s commercial vehicle exports

In the first half of the year, China’s exports of commercial vehicles to the top ten destination countries accounted for nearly 60%, and the rankings in major markets changed significantly. Russia firmly secured the top spot in China’s commercial vehicle export rankings, with its exports increasing sixfold year-on-year and trucks accounting for 96% (in particular heavy-duty trucks and towing vehicles). Mexico ranked second, with imports of commercial vehicles from China increasing by 94% year-on-year. However, China’s exports of commercial vehicles to Vietnam declined significantly, down by 47% year-on-year, causing Vietnam to drop from the second-largest destination country to the third. Chile’s imports of commercial vehicles from China also declined, by 63% year-on-year, falling from the largest market in the same period last year to fourth place this year.

Meanwhile, Uzbekistan’s imports of commercial vehicles from China increased by over two times year-on-year, elevating its ranking to ninth position. Among the top ten destination countries for China’s commercial vehicles, exports were predominantly trucks (accounting for over 85%), with the exception of a relatively high proportion of buses exported to Saudi Arabia, Peru, and Ecuador.

It took years for exports to exceed one tenth of total commercial vehicle sales in China. However, with Chinese OEMs investing more money and effort in overseas markets, China’s commercial vehicle exports are accelerating, and are expected to reach nearly 20% of total sales in the very short term.

Post time: Feb-18-2024